This is the place to chill, put your life aside and listen to my thoughts.

Tip: To enjoy, have a glass of _____ (whatever you like or my suggestion at the end of each post)

Tuesday, 29 December 2020

Closing Out 2020

Friday, 11 December 2020

Finance Investment Movement 4

Thursday, 3 December 2020

DBS Multiplier Crediting Rate Cut

Tuesday, 1 December 2020

Month of November 2020

Thursday, 26 November 2020

The Passing Of An Icon

Monday, 16 November 2020

CPF Top Up Nov 2020

Monday, 9 November 2020

US Post Election

Tuesday, 3 November 2020

A Conversation On Trump

Sunday, 1 November 2020

Month of October 2020

Friday, 23 October 2020

Restaurant Adventures 1

Friday, 16 October 2020

CPF Top Up Oct 2020

Thursday, 15 October 2020

Passive Power

Tuesday, 6 October 2020

Personal Accident Insurance 2020

Friday, 2 October 2020

Singlife Crediting Rate Cut

|

| Source: Singlife Website |

Thursday, 1 October 2020

Month of September 2020

Wednesday, 30 September 2020

CPF Top Up Sep 2020

Friday, 18 September 2020

The New Buzzword

If someone asks you, there is this word that either excites your senses or scares the life out of you. It has become such a prevalent verb used a lot by government officials, bosses and techies. It has the connotation that one must have a creative mind. Or there must be much resources at your disposal before an idea becomes feasible. Or it's somewhat binary where you do well or simply cannot do. There's really no in between, either you succeed or fail. The word is "Innovate".

In a recent conversation, I came away with a new perspective on how to view this. When you are given a task to innovate, often the approach is to create something new, like ditching a regular phone and in its place, make a smart phone. This is product innovation and probably most commonly heard. An "upgraded" version of innovate is to take the smart phone and find ways to produce it cheaper or add new functions to increase its appeal. This is known as process innovation. Yet another way is to improve the smart phone's sales probability by providing better marketing channels, technical support and delivery time. This is service innovation. The first two types deal with internal stakeholders while the last deals with the external.

Which of the above is the most difficult type of innovation? I think it's product innovation. I also have a feeling that most people correlate innovation with product creation. From a petrol driven vehicle to a fully electric one, this innovation leap is usually onerous and time consuming. That's what a person immediately feels upon hearing that dreaded word. He is defeated before work has even begun. I see much of this in my workplace. Hopefully, I would be able to share this new thinking with more people next time and reduce the stigma of what it means to innovate.

Tip: Masumi Sanka Junmai Daiginjo

Friday, 11 September 2020

Push Towards Blockchain

The most exciting industry to be in now is probably technology related. Within it, the domain of cryptocurrency is the most intriguing. It's been 12 years since the first creation of Bitcoin and my guess is the majority of the world is still rather clueless about this technology and its potential advancement.

The Covid situation has taught the world some useful lessons. Medical demands were well beyond planned capacities, people couldn't get out of the house and business supply chains were severely disrupted. The simple message is, "We live in an imperfect world." And this is where I believe blockchain could help resolve some of the issues. Even as the infection numbers continue to rise, researchers are racing against time and desperation grows. Among these, disinformation is a great problem. Whatever numbers we hear in news are controlled. Be it death tolls, vaccine trial successes, job losses, funds expended to sustain businesses etc. I think faith in the government systems and trust in leaders are at a deficit. It's got to do with this huge unknown that the virus brought.

But life must go on and through every disaster, humans ultimately find a way to get up. In this instance, blockchain has a role to play. What it potentially brings to the table are borderless transactions, cashless payments, verifiable information, lower fees and much more. All these seek to improve transaction efficiency, bridge information gap and bring trust back to people to the world we live in. A cryptocurrency is just a product out of this brand new ecosystem. During this evolution, pain would be felt by those who continue to resist as they are forced into a new life/work environment. That's what a single virus could do.

Tip: Ippin Junmai Daiginjo

Tuesday, 8 September 2020

Finance Investment Movement 3

Tuesday, 1 September 2020

Month of August 2020

https://drinkingspot.blogspot.com/p/finance-sharing.html

Friday, 21 August 2020

4 Days of Seminars

The SMEICC is an annual event for people to learn about the general business environment and issues of the day. I attended 4 webinars and learnt much from a particular speaker, so I thought it would be good to share.

The topic was about changing business and speed up the transformation process. My prior impression was it would revolve around adopting new technologies and mindset to existing businesses. What the speaker mentioned was along those lines but presented in a numerical and simple way that caught my attention.

2 main concepts were introduced. The first was in the world's labor market, 4% was involved in agriculture, 4% in manufacturing, 4% in high technologies and the rest in services. Ever since the second world war, all countries embarked on the peaceful development model and the equilibrium led to the resultant labor allocation. With upcoming technologies (AI, data analytics, robotics, digitization), the great upheaval would impact the 88% labor providing different services. The second concept talked about governments would not allow economic collapse and the only way was to continue money printing. This will lead to inflation and widen the wealth gap. Therefore, the global money flow must conceivably go into assets of high value such as property and stocks. The latter would then propel companies with forward looking ideas such as innovative technology. That's why many entrepreneurs eg Tesla don't mind burning money to achieve their target, mainly because the funds come from the masses who believe in them. As the level of sophistication increases, menial labor jobs would be replaced causing great unemployment. This can be seen in retail examples like food ordering on a touch screen, online shopping and hotel service robots. No sector would be spared so it's imperative that people must start thinking about their value. The areas where robots have yet to develop are emotion, cultural understanding and creativity. As jobs become automated and mechanized, the older generation will likely hang on to their positions due to better health and ability to control the situation. This is a terrible combination if businesses were pinned to where they are, without technological upgrade. Hence, the future is bleak for young people who are regular employees or have high ambitions to climb the corporate ladder. Fortunately, amid the changes, Singapore is likely to emerge stronger as the trust premium is high, business environment is sound, government is stable and workforce is highly educated.

Tip: Suntory Premium Black Malt

Thursday, 20 August 2020

Finance Investment Movement 2

I have an IG account for years though it's been pretty dormant as I used it previously to learn currency trading. So a reminder came to tell me that I have not done anything over the past 2 years and if this continues, an inactivity fee would be charged. Naturally, I logged into the account, funded it and placed a small trade, earning $4 in the process after a few hours. During the waiting time and monitoring the position, I looked at the stock market and read a few charts.

The market movement was slack and moving listlessly sideways. My take on the market is it's waiting for a signal from any source and blue chips were already battered down. Covid has been around for more than 6 months now and prices should have more or less moderated to include business impact. Therefore, to prepare for a recovery market play, the horizon to look would be longer term and cyclical stocks were a good bet. Hence, I purchased 1000 Capitaland shares to begin my first investment into a property counter in over 10 years! It has a well-diversified portfolio mainly in Singapore and China, trading at good PB of 0.6 and with expected improvement in retail/hospitality situation, I thought the downside risk is much covered. Even if the price was to drop 20%, I am likely to add each time that happens.

Tip: Yamazaki Single Malt 12

Tuesday, 11 August 2020

CPF Top Up Aug 2020

After paying the credit card bills of last month, there were some cash surplus so I decided to put $800 into the family's CPF accounts. This is something that I started this year to realize the power of compounding. Also, it's the wife's birthday so this serves as an invisible gift to her. Hopefully, by the time she can start withdrawal, the amount would be something decent. At the moment, I have no particular target to achieve. As an example from an actual CPF statement I saw, at age 65, a person with $102000 can expect to withdraw $662 for the rest of life. My opinion is this amount is too little for our lifestyle which means I have to save harder.

Tip: Iced Kopi

Monday, 3 August 2020

Month of July 2020

Thursday, 16 July 2020

2020 Post Election Thoughts

Monday, 6 July 2020

Finance Investment Movement 1

Tuesday, 30 June 2020

Month of June 2020

Friday, 26 June 2020

Let the Party Begin!

Monday, 15 June 2020

Stages of Life

|

| How Many Are There? |

Thursday, 4 June 2020

Dental Servicing

Tuesday, 2 June 2020

Saving VS Spending

|

| Which way to go? |

Monday, 1 June 2020

CPF Top Up Jun 2020

Sunday, 31 May 2020

Upgrade Phone Plan

Wednesday, 27 May 2020

Health Talk

Monday, 25 May 2020

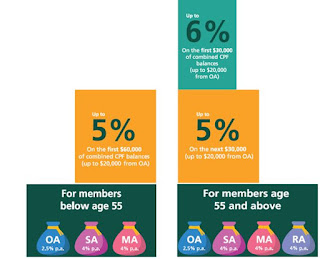

CPF Interest Rate till Sep 2020

|

| CPF Interest Rates Jul to Sep 2020 |