**Before you read further, I want to qualify that the below is purely a work of creative thinking.

Since the Prime Minister decided to talk about the topics of HDB and CPF, I thought it would be fun to chip in some ideas. Let me put myself into the shoes of Perm Sec MND and dream a little.

To start off, I'm outlining some basis and assumptions that guide this post's direction.

a) A HDB flat is meant for stay, be affordable and not for investment. The current situation requires ways to address flat affordability, uneven wealth distribution, inclusivity for poor and elderly and help for young generation to start a family. As shall be shown, my measures are meant to reduce BTO price and curb resale values, essentially rebooting the system with new rules.

b) CPF is for retirement. As a safety net, the CPF must not be allowed to fluctuate too much from its contributed amounts. Its goal is to be a long term accumulation tool and ensure a stable payout at the appropriate time.

Now, the dream begins. Even if some figures below may be farfetched, it's because I didn't do in depth calculations. So this is a broad outline and my personal (maybe somewhat controversial) take.

1) The BTO scheme will be revamped and prioritized for Newcomer (defined as first time married couples and/or singles above 29 years old). Such applicants must choose a flat if their queue number permits, otherwise they lose the status of a Newcomer for three years. Any leftover BTO flats will then be opened to others on a ballot basis with families having at least one Singaporean child given five times additional chances. The MOP is 20 years but has an option that allows the owner to sell the flat after 10 years. If this happens, the transaction value is subjected to 20% tax, decreasing 1% each year from the 11th year onwards, on top of point 2 below.

2) A new tax scheme, Seller's Windfall, will be introduced for resale flats. The first S$400k of the transacted flat value shall be exempted and amounts above that are placed in tiered categories and imposed a taxable percentage, up to 60%.

3) The BTO salary ceiling will be revised to S$12000, housing loan payment via CPF shall be capped at S$1000 per person per month, therefore the remainder is by cash. The lending value of a house loan is capped at 70% of the valuation or sale price.

4) For private housing, each couple or single (above 29 years old) can own 1 HDB and 1 private apartment. Landed owners (defined as non strata titled land) will not be allowed to purchase a HDB flat. If a landed owner sells away his house, he becomes eligible to do so immediately. Any violation of holding both a landed property and HDB concurrently for more than 6 months will be heavily penalized. A year long exercise will be launched to check all residents' stated NRIC address against actual living address. ABSD for second apartment purchase (exclude HDB in calculation) and above starts from 30%.

5) Existing grants will be removed or reduced and focused mainly on the lower income tier and couples below 35.

6) The EC and PLH scheme will be discontinued.

7) HDB is to embark on a 10 year building plan to achieve 30000 flats per year. During this period, the aims are to sooth supply constraints, encourage those with expiring leases to move and young couples to start a family early. Among the new BTO flats, these include a variety of one to four bedrooms (up to 1800sqft). Certain floors eg second to fifth levels in certain blocks are earmarked for retirees only. These are one or two bedrooms flats strictly on a rental basis. The household nucleus for this may include the retiree (with spouse) and son(s)/daughter(s). A retiree's grandchild is not included and therefore the parent(s) must move out. Once the retiree (including spouse) passes away, the flat is returned and prepared for the next occupant.

8) State clearly any flat upon reaching 99 years will be returned at zero value. Only a small percentage of flats may be eligible for SERS and the probability decreases while point 7 is being implemented. HDB will commit to make an offer to acquire flats with leases less than 15 years (amount expected to be token value contributing partly as down payment for next flat). It is a one time event and requires 80% resident's support. If rejected, then the flat follows its due course.

9) CPF in OA can only be used for housing (per point 3). CPF in SA can only be used for government securities, fixed income instruments or fixed deposits.

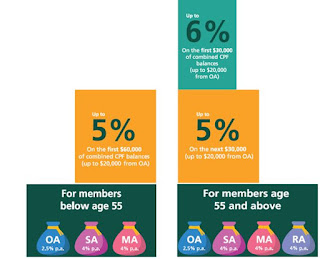

10) The interest rate for the various CPF accounts will remain for now but starting from the next review and subsequently, it will be adjusted under the formula (6 month Sora - 0.5%), subject to a minimum of 2% in OA and 4% in SA/MA.

Tip: Chateau Ferrande Graves Rouge 2017, tobacco and woody, inviting bouquet, slim finish